Inca One Signs Option Agreement for the Las Huaquillas Gold-Copper Project in Peru

Vancouver, B.C., May 16, 2011 - INCA ONE METALS CORP. (TSX‐V: IO) (“the Company” or “Inca One”) is pleased to announce that it has entered into a definitive letter agreement (“Agreement”) with Rial Minera SAC (“Rial”) and its shareholders (the “Optionors”), pursuant to which it has been granted an option to acquire all of the issued and outstanding shares of Rial (“Rial Shares”). Rial is a private Peruvian company that owns a 100% interest in the Las Huaquillas gold‐copper project (the “Project”), located in the Department of Cajamarca in northern Peru. The Project is easily accessible by road and is situated at a relatively low elevation of between 1000 to 1800 meters. It consists of 9 mineral concessions and is 3700 hectares in size.

Peru, a mineral rich country, is the largest gold producer in South America (6th worldwide), the world’s largest producer of silver and the 2nd largest producer of copper worldwide as of 2009. (1) “The Cajamarca mining district, located in northern Peru, has one of the largest gold inventories in South America with the economic high‐sulphidation Yanacocha Au mine, plus several smaller Au epithermal and porphyry Cu‐Au deposits.” (2)

Several gold targets and two porphyry copper‐gold systems have been identified on the Project to date:

a) Gold targets include the 2.2 km long Los Socavones Zone, including the El Huabo and Las Huaquillas showings and the Porvenir‐Guabo Alto high‐sulphidation epithermal zone.

b) Porphyry Cu‐Au: The Cementerio and San Antonio Cu‐ Au porphyry systems.

Previous exploration on the Project by Cooperacion Minero Peruano ‐ Alemana (1988‐1992) and Sulliden Gold Corporation Ltd. (TSX: SUE, “Sulliden”) (1996 ‐ 1999) consisted of surface geological, geochemical, and geophysical studies, 26 drill holes and 1200 meters of underground workings.

In 1998, Sulliden estimated that a 500 meter section of the 2.2 km long Los Socavones Zone hosts a geological resource of 6.57 million tonnes grading 2.09 g/t Au and 25.2 g/t Ag, equivalent to 443,000 ounces of gold and 5.3 million ounces of silver. This has been calculated at a cutoff of 1.5 g/t gold, and remains open at depth and along strike. This historic resource, based on 10 drill holes and 20 mineralized intercepts, was estimated by Sulliden to a depth of 200 meters.(3)

The historic resource was calculated in 1998 and the Company has not completed the work necessary to have the historical estimate verified by a Qualified Person. The Company is not treating the estimate as a current NI 43-101 defined resource and the historical estimate should not be relied upon. The Project will require considerable future exploration which the Company intends to carry out in due course.

The average true width encountered to date of the Los Socavones gold mineralization is 20+ meters, with some intercepts more than 75 meters in true width. Only a quarter of the length of the Los Socavones Zone has been drill tested in some detail. See attached geology plan map (Figure 1) and Los

Socavones Zone drillhole cross section (Figure 2). Table 1 below summarizes some highlighted mineralized intercepts of the Los Socavones Zone. (3)

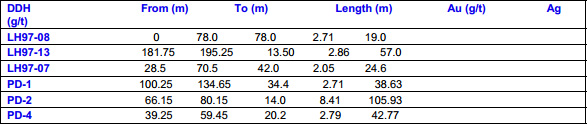

Table 1: Highlighted mineralized intercepts of the Los Socavones Zone. (3)

Sulliden drilled exploratory holes in the Cementario and San Antonio copper‐gold‐porphyry systems (each system is more than 1 kilometer across) based on soil, rock, and IP anomalies. The best hole at Cementario (LH97‐04) intersected 99.5 meters of 0.47% Cu and 0.11g/t Au.(2)(3) A technical report in compliance with NI 43‐101 is in progress for Las Huaquillas and a social plan is being formulated. “Inca One is excited to acquire this significant underexplored gold project in Peru, which includes two untested copper porphyries as well. We look forward to advancing all of these projects through systematic exploration and development to build shareholder value,” commented Edward Kelly, President and CEO of Inca One Metals.

Pursuant to the Agreement, the Company can acquire 100% of Rial Shares, of which 95% may be acquired by: (a) paying an aggregate of US$5,000,000 to the Optionors; (b) issuing 5,000,000 common shares of Inca One to the Optionors; and (c) incurring exploration expenditures of US$10,000,000 on the Project, all over a period of four years. Upon Inca One acquiring 95% of Rial Shares, a 1% net smelter royalty shall be payable to the Optionors on all future production. After completion of the cash and share payments and exploration expenditures as set out above, Inca One can earn a further 5% of Rial Shares by issuing an additional 3,000,000 common shares to the Optionors within 15 days of notice of exercise of the original option. In addition, Inca One shall issue to one of the Optionors as bonus payments one (1) common share of Inca One per each new ounce of gold or gold equivalent (measured and indicated) that is found or determined to exist on the Project by Inca One, in excess of 560,000 ounces of gold or gold equivalent, to be delivered upon public announcement of such discovery.

Finders’ fees in cash, shares, or a combination thereof may be paid in accordance with TSX Venture Exchange (“Exchange”) policies. Completion of the transaction is subject to, among other things, typical closing conditions, approval by the Exchange and confirmatory due diligence by Inca One.

Inca One is also pleased to announce that it has arranged for a non‐brokered private placement of up to 5,000,000 units at a price of $0.40 per unit for gross proceeds of $2,000,000. Each unit will consist of one common share and one‐half of one transferable common share purchase warrant (“warrant”). Each whole warrant will entitle the holder to purchase an additional common share of the Company at a price of $0.75 per common share for a period of two years, subject to an acceleration provision whereby if at any time from four months and one day after the closing of the financing, the trading price of the Company's common shares on the Exchange over a period of 10 consecutive trading days exceeds $1.00, the Company may, at its option, provide notice to the warrant holders that the warrants will expire on the date which is 30 calendar days after the date of such notice. Finder fee’s (consisting of cash or units

having the same terms as in the placement) will be paid in accordance with Exchange policies. The proceeds from this private placement will be used to fund the acquisition of the Las Huaquillas Project and its work programs. Closing of the private placement is subject to acceptance for filing by the Exchange.

The technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in NI 43‐101 and reviewed on behalf of the Company by Thomas A. Henricksen, PhD, a Qualified Person under NI 43‐101.

Inca One Capital is a Canadian based exploration stage company engaged in the acquisition, exploration and development of mining assets in South America. Inca One is in the process of opening a new office in Lima, Peru.

On behalf of the Board, INCA ONE METALS CORP.

Edward Kelly

CEO

For more information contact the Company at: Telephone: (604) 669‐9788 Facsimile: (604) 669‐9768 ir@incaone.com

www.incaone.com

(1) Source: US Geological Survey (2009 Minerals Yearbook - Peru, February 2011)

(2) Source: Tectonic, Magmatic and Metallogenic Evolution of The Cajamarca Mining District, Northern Peru. PHD Thesis; Richard Charles Idris Davies. December 2002.

(3) Source: Sulliden Annual Report filed August 12, 1998, available on www.sedar.com

Statements in this press release regarding the Company which are not historical facts are “forward‐looking statements” that involve risks and uncertainties. Such information can generally be identified by the use of forwarding‐looking wording such as “may”, “expect”, “estimate”, “anticipate”, “intend”, “believe” and “continue” or the negative thereof or similar variations. Since forward‐looking statements address future events and conditions, by their very nature, they involve inherent risks and uncertainties such as the risk that the closing may not occur for any reason. Actual results in each case could differ materially from those currently anticipated in such statements due to factors such as: (i) the inability of the parties to consummate the definitive letter agreement; (ii) fluctuation of mineral prices; (iii) a change in market conditions; (iv) the inability to produce the technical report for any reason whatsoever; and (v) the refusal of the Exchange to accept the proposed transaction for any reason whatsoever. Except as required by law, the Company does not intend to update any changes to such statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.